Growth of U.S. B2B Exhibition Industry Continues

submitted by CEIR

DALLAS – The Center for Exhibition Industry Research (CEIR) announced today that the U.S. business-to-business (B2B) exhibition industry continues to rebound, recording further improvement in the first quarter of 2024. Continued improvement in metrics outcomes for completed events – especially the strong rebound of exhibition attendance – boosted the Q1 2024 Index value to 92.3. As expected, the CEIR Total Index – a measure of overall exhibition performance – continues to recover, surging 4.3% from a year ago.

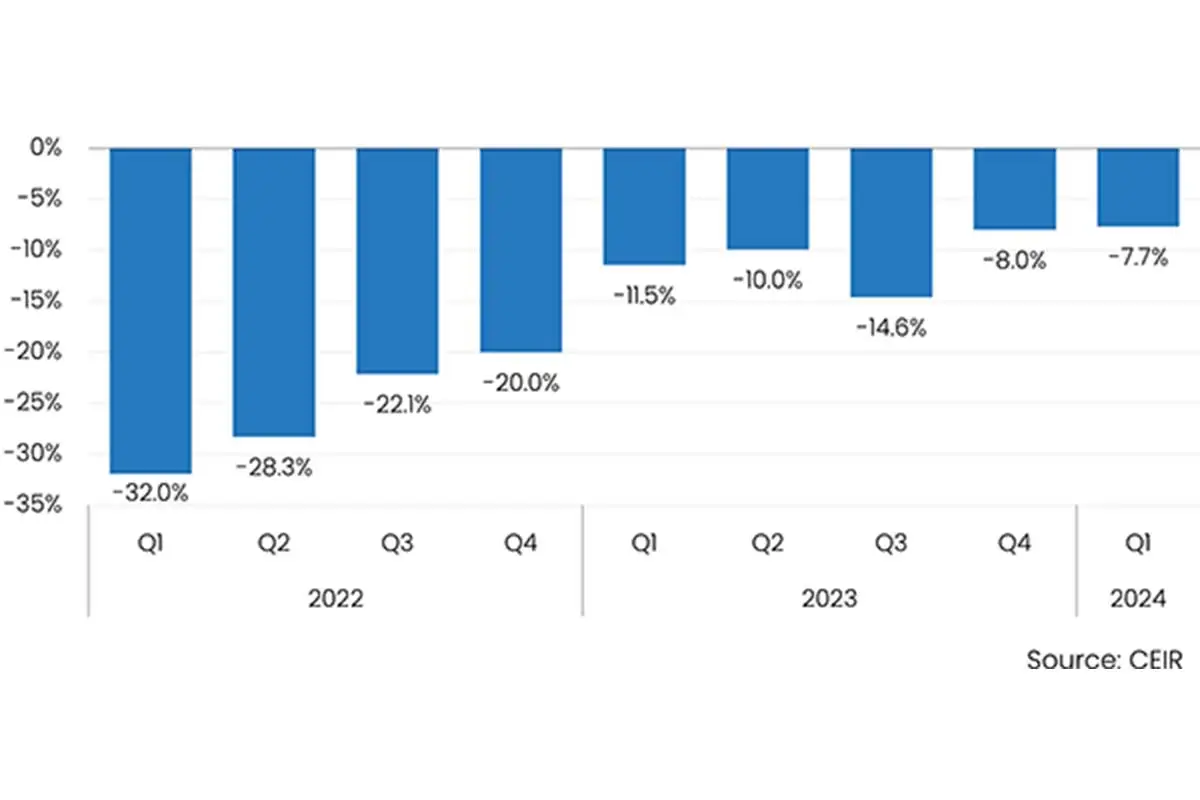

Figure 1: CEIR Total Index, % Change from 2019, 2021-2023

Performance registered 7.7% below the same period in 2019, marking a gain compared to the past two years, which included a 32.0% shortfall in Q1 2022 and an 11.5% deficit in Q1 2023. As evidence of continued momentum, the Q1 CEIR Total Index gained 0.3 percentage points compared to Q4 2023.

Figure 1 illustrates exhibition industry performance for events occurring between Q1 2022 and Q1 2024, compared to the same quarter in 2019. The latest results for Q1 2024 show modest growth relative to the fourth quarter of 2023, which is consistent with macroeconomic performance. Among all events in the Index sample, 41.8% have surpassed their pre-pandemic CEIR Total Index performance. This represents a jump from Q1 2023 when only 34.5% of events held in that quarter surpassed 2019 results.

The cancellation rate for in-person events remained low at 0.3%, on par with the cancellation rate during the same quarter in 2023 and significantly lower than the cancellation rate of 1.4% in Q4 2023.

“Even with a slowing economy, the latest CEIR Index readings confirm the resilience of exhibitions,” said Adam Sacks, President of Tourism Economics. “The industry continues on its track toward full recovery with the Index just 7.7% below pre-pandemic levels in Q1, showing the enduring value of exhibitions to company performance.”

Q1 2024 CEIR Metric Performance

Figure 2: Q1 2024 CEIR Metrics Relative to Q1 2019

Among the four components of the Total Index, the Net Square Feet (NSF) metric has recovered the most, exceeding the 2019 benchmark by 0.3%. The Attendees metric follows at just 3.4% below Q1 2019. Exhibitor participation has been slower to recover, with a shortfall of 11.2% relative to 2019, and Real Revenues (inflation adjusted) have been the slowest to recover from Q1 2019, with a shortfall of 15.5%.

“It is exciting to see CEIR forecasts become reality each quarter, documenting a steady pace in recovery,” noted CEIR CEO Cathy Breden, CMP-F, CAE, CEM. “That attendance is one of the best performing metrics is a good sign, as historically, it is a leading indicator.”

The U.S. Economy: Resilience Despite a Stumble to Start the Year

The CEIR Index results are consistent with overall economic performance that is showing resilience in the face of inflation and tight monetary policy. As expected, GDP growth slowed in Q1 2024 compared to the second half of last year, and this is reflected in the overall performance of the CEIR Index.

The slowdown in GDP growth may also be impacting hotel performance. First quarter hotel demand declined in the Economy and Midscale classes, perhaps the result of budget-conscious travelers succumbing to inflation and higher interest rates. Conversely, demand rose in the Luxury and Upper Upscale classes which capture the predominant share of conventions and group meetings (Figure 3).

Figure 3: Q1 2024 Hotel Demand, % change from Q1 2023

Oxford Economics’ business cycle indicator (BCI) shows the economy hit a rough patch at the start of the year, but this is not considered an immediate cause for concern (Figure 4). Consumer spending, the economy’s main economic engine, is holding up and risks to the expansion do not appear overly threatening. The weakness in the economy in Q1 may be a little hangover after the economy grew rapidly in the second half of 2023. However, the expectation is that the economy will show signs of recovery over Q2.

Unseasonable weather heavily impacted industrial production and real manufacturing and trade sales early this year, but this was temporary as there have been consecutive gains in industrial production in February and March. The improvement in industrial production has been supported by gains in tech and motor vehicles and parts.

The surprisingly strong gain in March retail sales underlined the strength of the consumer. This was confirmed by Q1 GDP, which showed consumption rose 2.5% at an annualized rate. With the tight labor market supporting gains in real disposable income, consumer spending will remain a support to GDP, and the growth in real consumer spending in Q2 is likely to be stronger than anticipated.

Figure 4: Oxford Economics’ U.S. Business Cycle Indicator

CEIR released the 2024 CEIR Index Report recently, which analyzes the 2023 exhibition industry performance and provides an economic and exhibition industry outlook for the next three years. This annual report is a valuable resource for planning. It reports event performance on a per sector basis, and for the first time, by event size. Click here to purchase the report.

CEIR collects data directly from B2B exhibition organizers, who have an exclusive offer opportunity. When they provide their show data for 2019 through 2024 using either the Event Performance Analyzer tool or submitting results via the Index Survey available at the following link, they receive the CEIR Index sector report for their show at no cost. Data submission is strictly confidential. Click here to access the Index Survey link. For those interested in opening a complimentary Event Performance Analyzer account, click here.

About CEIR

The Center for Exhibition Industry Research (CEIR) serves to advance the growth, awareness and value of exhibitions and other face-to-face marketing events by producing and delivering knowledge-based research tools that enable stakeholder organizations to enhance their ability to meet current and emerging customer needs, improve their business performance and strengthen their competitive position. For additional information, visit www.ceir.org.

About Oxford Economics

Oxford Economics is one of the world’s foremost independent global advisory firms, providing reports, forecasts and analytical tools for 200 countries, 100 industrial sectors and over 3,000 cities. With our Tourism Economics subsidiary, we deploy best-in-class global models and analytical tools to forecast external market trends and assess their business impacts. Headquartered in Oxford, England, with regional centers in London, New York, and Singapore, Oxford Economics has offices across the globe, employing over 600 full-time staff and one of the largest teams of macroeconomists and thought leadership specialists. Learn more at www.tourismeconomics.com / www.oxfordeconomics.com.