Your CFO slides the monthly P&L across the desk. Revenue is up 28 percent year-over-year. You should feel victorious.

Instead, you feel sick.

EBITDA is down 12 percent. Cash flow is tighter than it was when you were half this size. Your controller is asking for the third working capital injection this quarter.

The Lie We Tell Ourselves About Revenue Growth

Revenue feels good. Every new contract, every growing customer, every month that’s bigger than the last one tells us we’re winning.

But revenue is fool’s gold.

Revenue doesn’t pay your people. Revenue doesn’t cover your loans. Revenue doesn’t fund what’s next or let you sleep at night.

Profit does.

Yet we chase revenue like it’s the only number that matters. We celebrate hitting revenue goals, pay bonuses based on revenue, and show revenue growth to our boards like it proves we’re successful.

Here’s the problem: growth often creates costs faster than it creates profits. For companies our size, this isn’t rare – it’s normal.

Why Growth Makes You Poorer

Growing companies face something stable companies don’t: every new dollar of revenue needs investments that don’t grow at the same rate.

Here’s what happens:

Growth Eats Cash

Bigger projects mean bigger upfront costs. More materials to buy. Longer waits to get paid. Higher insurance. Bigger bonds.

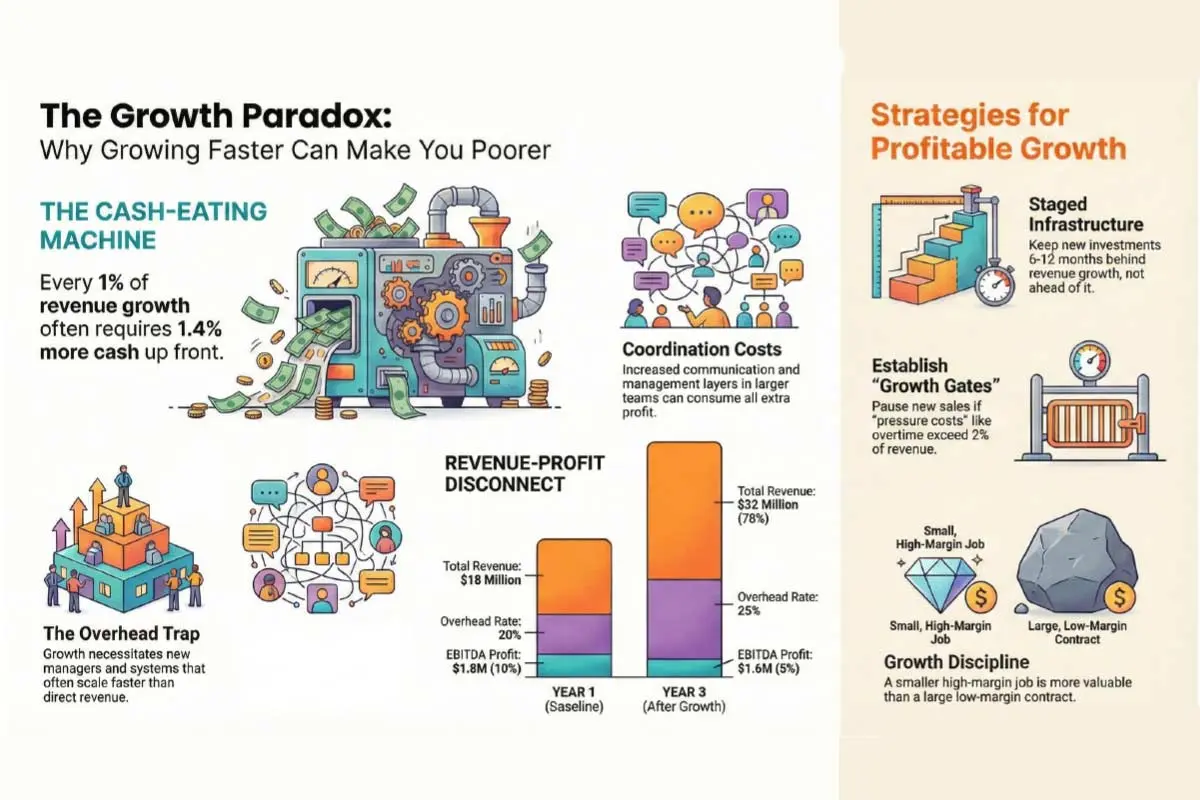

One exhibit company figured out that every 1 percent of revenue growth needed 1.4 percent more cash up front. They were borrowing money to do profitable work. Growth became a cash-eating machine.

You Need More People and Stuff

When you go from $15M to $30M in revenue, you don’t just double your direct costs. You need new managers, better systems, more space, and support people you never needed before.

A construction company I worked with grew from $12M to $45M in three years. Revenue went up 3x but overhead went up 4x. They needed project managers, estimators, safety people, and office staff they never had. Each hire made sense for the work they had, but together they ate profit faster than new jobs could create it. EBITDA dropped from 12 percent to 4 percent while revenue tripled.

Everything Gets More Complicated

Small companies run lean because everyone does multiple jobs and nothing needs to be formal. Growth means specialists, which means coordination, which means managers, which means systems, which means overhead.

The “coordination cost” often grows much faster than revenue. A $10M company might have 3 people making decisions. A $50M company might have 15. Just the meetings and communication can eat up all the extra profit.

The Real Numbers Behind Revenue Growth

Let me show you what this looks like with real numbers from a mid-market manufacturing company:

Year 1 Baseline:

- Revenue: $18M

- Direct Costs: $12.6M (70 percent)

- Overhead: $3.6M (20 percent)

- EBITDA: $1.8M (10 percent)

Year 3 After “Successful” Growth:

- Revenue: $32M (78 percent increase)

- Direct Costs: $22.4M (70 percent – stayed consistent)

- Overhead: $8.0M (25 percent – increased due to infrastructure)

- EBITDA: $1.6M (5 percent – dropped despite revenue growth)

They nearly doubled revenue and made less money. The overhead rate increased just 5 percentage points – they brought on two operations managers, a full accounting team, and upgraded to enterprise software – but that was enough to turn growth into a profit killer.

How to Build Profitable Growth

Track the Right Metrics

Stop leading with revenue growth. Start leading with profit growth. Track:

- Gross margin per customer

- Overhead rate trends

- Cash conversion cycles

- Profit per employee

Implement Staged Infrastructure Growth

We build for where we want to be, not where we are. That new building, upgraded software, extra manager – all needed for future growth, all eating current profits.

Don’t build for peak capacity. Build for current capacity plus 25 percent. Then upgrade again. Rent before you buy. Outsource before you hire. Multiple smaller investments preserve cash flow better than single large investments.

Keep new investments 6-12 months behind revenue growth, not 12-24 months ahead.

Small problems become expensive when you multiply them. That manual process that costs $500/month becomes a $2,000/month problem when volume doubles. Fix problems before you scale them. Every process that works “good enough” now should be improved before you double your volume.

Create Growth Gates

Fast growth creates pressure to deliver. When you’re behind or overloaded, you do whatever it takes. Overtime pay, rush orders, expensive subcontractors, saying yes to scope changes.

Track these “pressure costs” separately. When they hit 2 percent of revenue for two months running, slow down new sales until you can deliver profitably again.

Establish profit thresholds that must be maintained during growth. If EBITDA drops below target for two consecutive months, pause new business development until operational efficiency recovers.

Design Growth Discipline

Fast growth often means taking jobs you normally wouldn’t. Lower-margin work, difficult customers, projects outside your wheelhouse.

Not all growth opportunities are worth pursuing. Develop clear criteria for acceptable projects: minimum margin requirements, maximum project size relative to current capacity, geographic boundaries, client qualification standards.

A specialty contractor implemented this discipline. They stopped accepting the 12-14 percent margin work that had filled their pipeline and set new standards: no project below 18 percent gross margin, no client accounting for more than 15 percent of annual revenue, no geographic work beyond 200 miles. They grew from $8M to $15M over two years while increasing EBITDA from 8 percent to 14 percent.

Keep your standards even when growing. Track profit per customer, not just revenue per customer. A $500K job at 15 percent margin beats a $1M job at 6 percent margin.

The Growth Paradox Resolution

The companies that scale profitably understand a counterintuitive truth: sustainable growth requires saying no to revenue opportunities that don’t create profit opportunities.

Revenue growth without profit growth isn’t business development – it’s business consumption. You’re literally working harder to make less money while taking on more risk.

The path forward isn’t to stop growing. It’s to grow smarter. Build infrastructure at the right pace, maintain operational efficiency, protect margins, and track the metrics that actually matter.

Because at the end of the day, a profitable $20M company beats a cash-strapped $40M company every single time.

Most CEOs celebrate revenue growth in public and worry about profit erosion in private. The companies that scale successfully do the opposite.

Jane Gentry helps CEOs navigate growing pains through organizational design, people, and process alignment – a former PE-backed CEO with 25+ years of experience and a Harvard MBA mentor, she works with leaders who refuse to let growth create chaos.