Unflattering attention is on Lancaster County Convention Center in Pennsylvania due to failed bond negotiations, which could impact future bookings for the venue that has hosted events up to 5,000 people since 2009.

Holding $64 million in bonds on the $178 million Lancaster County Convention Center, Wells Fargo has yet to be paid in full by facility manager Lancaster County Convention Center Authority (LCCCA), which has publically struggled to make bond payments since 2012.

Holding $64 million in bonds on the $178 million Lancaster County Convention Center, Wells Fargo has yet to be paid in full by facility manager Lancaster County Convention Center Authority (LCCCA), which has publically struggled to make bond payments since 2012.

Expected to cover bond interest payments with its 80 percent share of Lancaster County’s 3.9 percent hotel room tax, LCCCA’s revenue fell short. To avoid defaulting on payments to Wells Fargo, LCCCA was given the other 20 percent, about $1 million, of the hotel room tax that usually goes to Pennsylvania Dutch Convention and Visitors Bureau. This interrupted the Bureau’s promotional activities within Lancaster County.

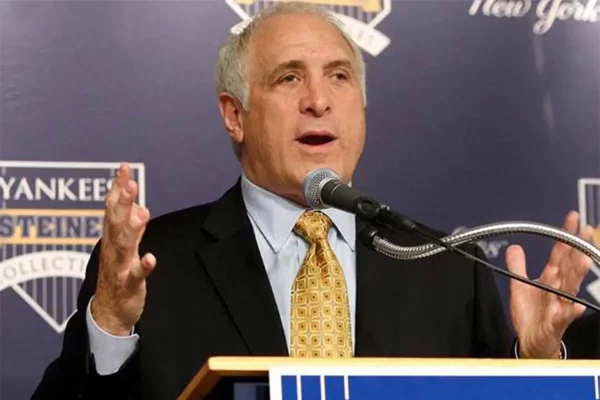

LCCCA officials said they hope that educating potential clients and stakeholders will prevent any fallout from a failed plan proposed by Lancaster County Commissioner Scott Martin, who wanted to restructure the bonds to cut interest rates, but this plan involves bond swapping and violates a Pennsylvania law.