Elon Musk once said: “When digital media is ubiquitous, the scarce commodity will be live events.”

He was right about the first part. When everything moves online, face-to-face meetings do become more valuable. But there’s a second part to this equation—and it deserves closer attention: Demographic Shifts.

The workforce that has filled convention centers for decades is changing in size and composition. And that has significant implications for the event industry & billions being invested in convention infrastructure.

The Demographic Reality

The Baby Boomers who have filled convention halls for the past forty years are retiring. Generation X, their successors, represents a smaller cohort. Millennials are now in their prime working years, but the numbers don’t quite add up to a one-for-one replacement. Gen Z is smaller still.

Walk through any tradeshow floor today and attendance looks strong. Industry analysts predict the market will reach $17.3 billion by 2028, with most exhibitors optimistic about the future.[1] But 2028 represents a high-water mark rather than a new baseline. The trajectory after that is concerning and warrants attention.

The Transition Period: 2028-2032

The 2028 to 2032 window is where demographic trends become more apparent in attendance patterns. This four-year period could mark the shift from fifty years of growth to a period of significant contraction.

By 2030, with a quarter of Americans over 65 and labor force participation projected at 60.4 percent,[2] attendance patterns are likely to shift. Regional shows and second-tier events may see the impact first—analysis suggests attendance declines of 10 to 15 percent as corporate travel budgets tighten and companies become more selective about which events to attend.*

By 2032, the trend line becomes clearer. Demographic-based projections suggest attendance could decline 15 to 25 percent from peak levels.* This would trigger consolidation, with shows merging or restructuring to maintain viability.

How the Market May Adapt

The events that continue will likely look different from today’s model. Musk’s prediction about scarcity creating value could prove accurate, but the market will be smaller and more exclusive.

Registration fees that range from $1,000 to $2,000 today could increase significantly—analysis suggests potentially to $5,000 to $15,000 for premium events.* Tradeshow attendance may shift from a broad-based business expense to a more selective investment focused on senior decision-makers. Companies may send fewer representatives or prioritize their attendance choices more carefully.

The attendee profile will skew older—55 and above—with greater purchasing authority but different travel preferences. Virtual and hybrid attendance options will become standard requirements rather than optional features, accommodating professionals who prefer to limit extensive travel.

The exploratory “let’s see what’s new” aspect of tradeshows may give way to more targeted, intentional participation focused on specific business objectives and relationship development.

Industry consolidation seems likely, with 10 to 15 major destinations—Las Vegas, Orlando, Chicago, and others—commanding premium positioning. Based on current demographic trajectories, the industry could see 50 to 60 shows merge or restructure annually through the 2030s.* By 2050, the market might include roughly half the events we have today, serving half the attendees, while generating approximately two-thirds of current revenue through higher per-attendee value.*

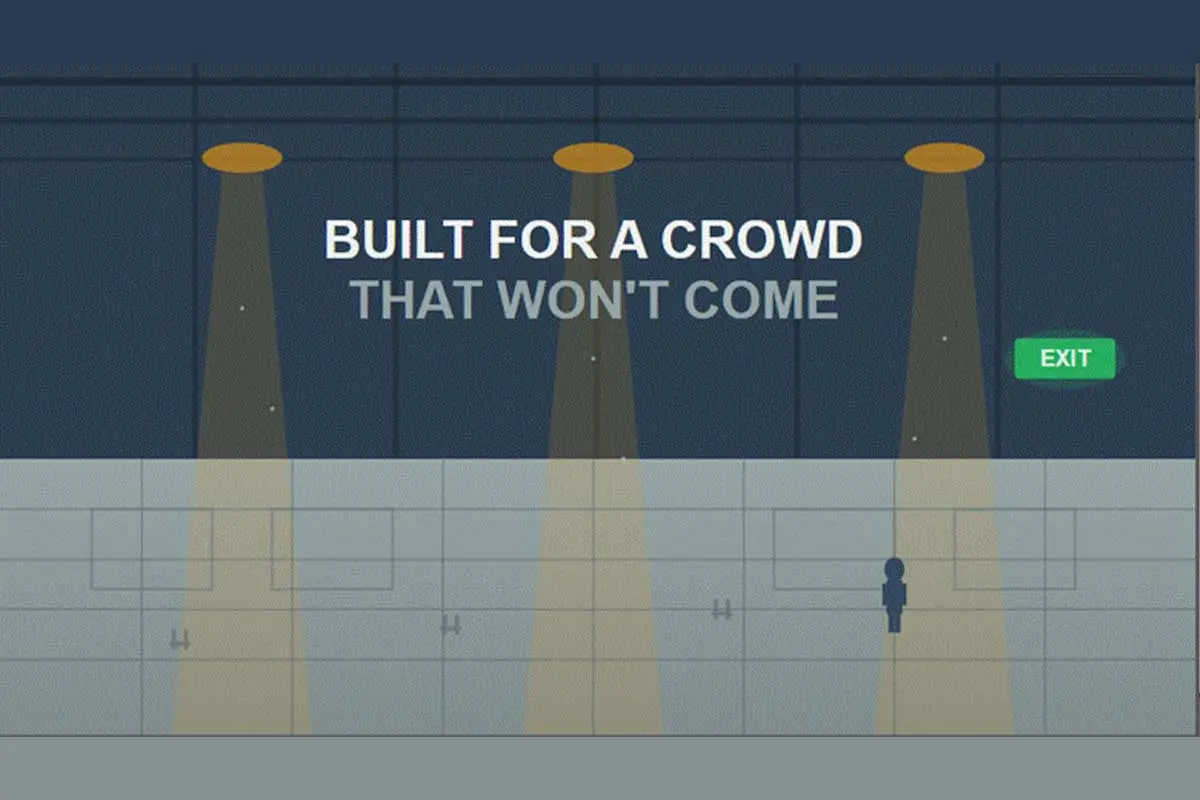

The Infrastructure Challenge

The tradeshow industry has adaptation options—adjust pricing, focus on quality, serve a different market segment. Convention centers, however, face a more complex situation.

These facilities were designed for attendance levels that may no longer be sustainable. Currently, most convention centers operate at 35 to 45 percent utilization even during strong market conditions,[3] requiring $5 to $15 million in annual taxpayer subsidies to cover operational shortfalls.[4]

If attendance declines by 30 to 50 percent as demographic trends suggest, these subsidies could increase substantially.* This creates budget pressure for cities: either reduce funding for other services or increase taxes on a potentially shrinking tax base. Both approaches accelerate resident and business relocation, creating a challenging fiscal cycle.

The structural challenge is significant. Convention centers are purpose-built facilities. The architectural features that make excellent exhibition halls—high ceilings, column-free spaces, extensive loading capacity—don’t translate easily to alternative uses like residential or standard office space. Conversion costs often approach or exceed new construction costs.[5]

Current Investment Decisions

What makes this analysis particularly relevant is the timing. Cities including Nashville, Phoenix, Charlotte, Austin, Houston, Dallas, and Fort Lauderdale have convention center projects currently underway or in planning stages. Major projects identified include Austin’s $1.6-1.8 billion expansion, Houston’s $2 billion modernization, Dallas’s $3+ billion rebuild, Fort Lauderdale’s $1.3 billion expansion, and Nashville’s proposed expansion.[6] Combined with projects in Wisconsin, Kentucky, Las Vegas, New Orleans, and Salt Lake City, the convention center construction and renovation activity represents billions in long-term municipal commitments.

These facilities are being financed with municipal bonds that typically carry 30-year terms, creating long-term taxpayer obligations. The question is whether the demographic and attendance projections used in these projects’ feasibility studies adequately account for the trends outlined here, or if they’re based primarily on historical growth patterns that may not continue.

Looking Ahead

The tradeshow industry will likely adapt successfully, potentially even improving profitability by serving a smaller, higher-value audience willing to pay premium prices for face-to-face connection that becomes increasingly rare.

The convention center infrastructure, however, presents a different challenge. These facilities represent long-term capital investments designed for attendance levels that demographic trends suggest may not be sustainable. The gap between the infrastructure we’re building today and the market we’ll have tomorrow deserves more attention in planning and investment decisions.

The critical question isn’t whether change is coming—demographic trends are well-established. It’s whether infrastructure planning is adequately accounting for these trends, or whether we’re building for the market we have today rather than the one we’ll have in 2035, 2040, and 2050.

Notes

*Indicates analytical projections based on demographic data rather than published industry forecasts. These projections represent informed analysis of potential scenarios given verified demographic trends from the U.S. Bureau of Labor Statistics and Census Bureau, but are not official industry consensus forecasts.

References

[1] Statista. “Value of the business-to-business (B2B) trade show market in the United States from 2018 to 2028 (in billion U.S. dollars).” MarketingCharts, August 2024. https://www.statista.com/statistics/865283/b2b-trade-show-market-value/; Giant Printing. “2025 Trade Show Statistics: The Latest Trends & Data in the U.S.” March 2025. https://giantprinting.com/trade-show-statistics/

[2] U.S. Bureau of Labor Statistics. “Employment Projections — 2020–2030.” News Release, September 2021. https://www.bls.gov/news.release/archives/ecopro_09082021.pdf; U.S. Bureau of Labor Statistics. “Number of people 75 and older in the labor force is expected to grow 96.5 percent by 2030.” The Economics Daily, November 2021. https://www.bls.gov/opub/ted/2021/number-of-people-75-and-older-in-the-labor-force-is-expected-to-grow-96-5-percent-by-2030.htm; U.S. Chamber of Commerce. “Workforce of the Future: What Businesses Need to Know.” July 2024. https://www.uschamber.com/workforce/data-deep-dive-the-workforce-of-the-future

[3] Industry standard maximum practical occupancy for convention centers is 70 percent (PWC analysis). The Convention Center Advisor. “Maximum Practical Occupancy.” https://mtmconsult.wordpress.com/tag/maximum-practical-occupancy/. Actual utilization rates vary by facility but typically remain well below this threshold during normal operations.

[4] Operating subsidies documented across multiple jurisdictions: Washington DC Convention Center ($95 million annually, 2014); Dallas Convention Center ($52.8 million annually, 2014); Orange County Convention Center ($292.4 million cumulative subsidies through 2025); Boston Convention Center ($12-15 million projected annual subsidy in early operations). Pearlstein, Steven. “Debunking the conventional wisdom about conventions.” The Washington Post, June 27, 2014. https://www.washingtonpost.com/business/steven-pearlstein-debunking-the-conventional-wisdom-about-conventions/2014/06/27/77cac02e-fd5f-11e3-932c-0a55b81f48ce_story.html; D Magazine. “Why Do We Need to Spend a Quarter-Billion Dollars on the Dallas Convention Center?” November 2014. https://www.dmagazine.com/politics-government/2014/11/why-do-we-need-to-spend-a-quarter-billion-dollars-on-the-dallas-convention-center/; WESH 2 Investigates. “Nonprofits want break on fees at Orange County Convention Center.” April 2025. https://www.wesh.com/article/nonprofits-want-break-fees-orange-county-convention-center/; City Journal. “Hosting Mostly Debt.” March 2023. https://www.city-journal.org/article/hosting-mostly-debt; Texas Comptroller. “Paying for Texas Convention Centers.” Fiscal Notes, August 2018. https://comptroller.texas.gov/economy/fiscal-notes/archive/2018/august/convention-centers.php

[5] City Journal. “The Convention Center Shell Game.” March 2023. https://www.city-journal.org/article/the-convention-center-shell-game; Brookings Institution. Convention Center analysis. https://cdnsm5-hosted.civiclive.com/UserFiles/Servers/Server_12493019/File/County%20Manager/RDA2/BrookingsInstituteOn%20IventCenters.pdf

[6] Major convention center projects: Austin Convention Center ($1.6-1.8 billion expansion, 2024-2029); Houston George R. Brown Convention Center ($2 billion modernization); Dallas Convention Center ($3+ billion rebuild planned); Fort Lauderdale Broward County Convention Center ($1.3 billion expansion, completion 2025); Wisconsin Center ($456 million expansion, completed 2024); Kentucky Exposition Center ($393 million two-phase project); Las Vegas Convention Center ($600 million renovation); New Orleans Convention Center ($557 million upgrade plus new hotel); Nashville Music City Center (expansion study completed June 2025). Northstar Meetings Group. “Major Convention Center Expansion and Renovation Projects.” October 2025. https://www.northstarmeetingsgroup.com/News/Event-Venues/convention-center-expansion-US; Vendelux. “2025 Convention Center Construction News & Expansions.” May 2025. https://vendelux.com/news/convention-center-construction-updates-2025/; Meetings Today. “4 U.S. Convention Center Projects That Are On-Trend.” https://www.meetingstoday.com/articles/143869/4-on-trend-convention-center-projects; Visit Nashville TN. “Music City Center Releases Expansion Study Results.” June 2025. https://www.visitmusiccity.com/media/press-release/2025/music-city-center-releases-expansion-study-results