Growth of US B2B Exhibition Industry Continues

submitted by CEIR

|

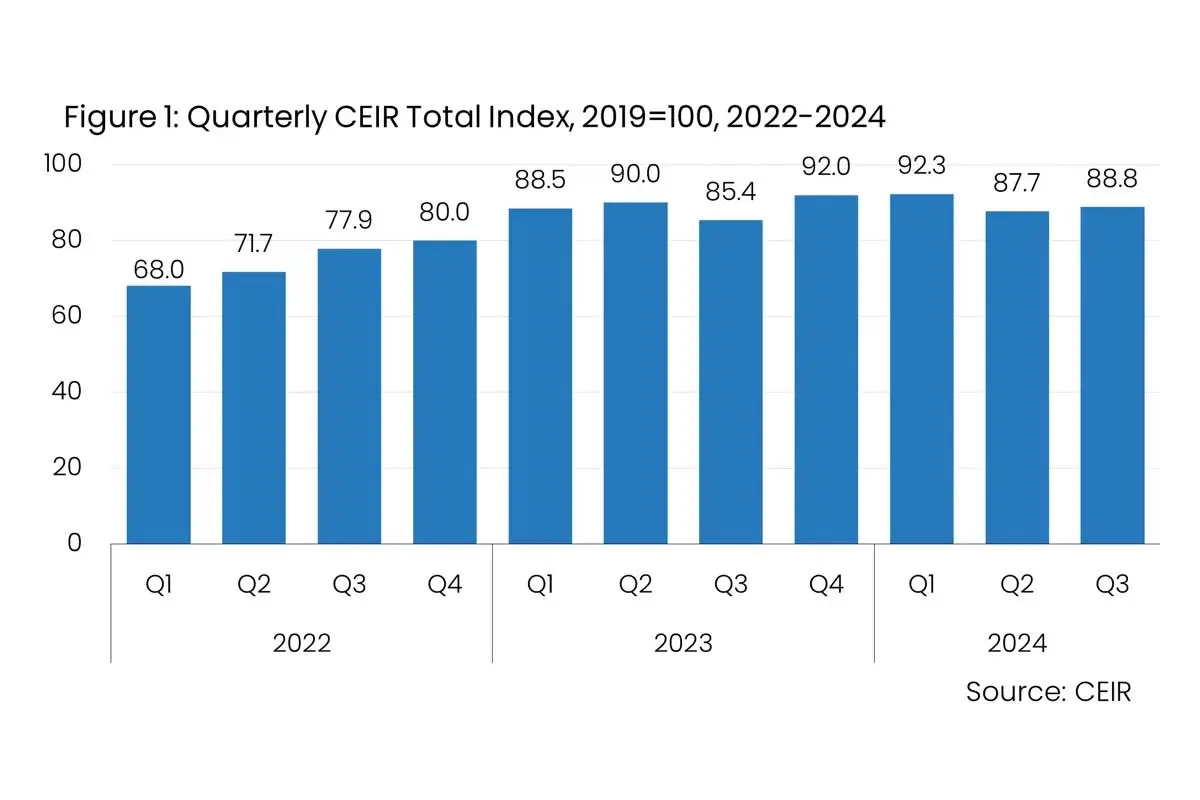

DALLAS, – The Center for Exhibition Industry Research (CEIR) announced today that the U.S. business-to-business (B2B) exhibition industry is picking up after a minor slowdown in the second quarter of 2024. Tempered performance for completed events – especially in exhibition attendance – set back the Q2 2024 Index value to 87.7 after a post-pandemic record 92.3 in Q1 2024. In Q3, the stronger performance of Net Square Feet (NSF) and exhibitor participation supported an increase to 88.8. |

|

|

The Q3 CEIR Total Index – a measure of overall exhibition performance – registered 11.2% below the same period in 2019, marking an improvement over the 14.6% shortfall in Q3 2023. The Index gained 3.4 percentage points compared to Q3 2023 and 1.1 points compared to Q2 2024. Figure 1 illustrates exhibition industry performance for events occurring between Q1 2022 and Q3 2024, compared to the same quarter in 2019. The latest results for Q3 2024 show a slight upturn relative to the second quarter of 2024, consistent with economic activity. Among all events in the Index sample, 33.8% have surpassed their pre-pandemic CEIR Total Index performance. This represents a significant increase from Q3 2023 when only 25.9% of events held in that quarter surpassed 2019 results. The cancellation rate for in-person events remained low at 0.3%, significantly lower than 1.6% in Q3 2023. “The data show a picture of continued rebuilding for the exhibition industry,” said President of Tourism Economics Adam Sacks. “These events remain vital to successful business operations and our forecasts for corporate performance support an outlook of further growth in 2025.” “The Q3 2024 CEIR Index reveals a resilient B2B exhibition industry on a continued path to recovery,” added IAEE President and CEO Marsha Flanagan, M.Ed., CEM. “While we are still tracking below 2019 levels, we are seeing encouraging signs of growth. CEIR will launch an Organizer Benchmarking Study at the outset of 2025, leveraging additional data sets. This research will provide additional understanding of lagging and leading indicators, to gain deeper insights and drive industry advancement.” Q3 2024 CEIR Metric Performance |

|

|

Among the four components of the Total Index, NSF has recovered the most, reaching just 2.7% behind 2019. The Exhibitors metric follows at 7.0% below Q3 2019. Real Revenues (inflation-adjusted) have been slower to recover, with a shortfall of 16.3% relative to 2019, and the Attendees metric has been the slowest to recover from Q3 2019, with a shortfall of 17.8% (Figure 2). While lower unemployment and lower interest rates are giving consumers an encouraging outlook, high prices continue to take their toll, potentially affecting trade show attendance. In fact, the University of Michigan’s consumer sentiment index fell from 70.1 to 68.9 in October, against forecasts for a small rise in the index. Comparing the results to events held in Q3 2023, we see a similarity with relative strength in NSF and lagging attendance. The U.S. Economy: On solid footing The CEIR Index results are consistent with U.S. economic performance, where the data paint an encouraging portrait. Annualized GDP rose 2.8% in the third quarter, with evident strength in consumer spending. The resiliency of the labor market and deceleration in inflation remain conducive to real disposable income growth. The Personal Consumption Expenditures (PCE) deflator registered a 2.3% year-over-year increase in Q3 – very close to the Federal Reserve’s 2% target. Real disposable income, key to consumer spending, increased 1.6% at an annualized rate in Q3, weaker than the gain in the prior three months, yet unalarming. Oxford Economics’ business cycle indicator (BCI) which tracks growth in key coincident indicators, ticked up modestly from its elevated levels at the start of Q3 (Figure 3). Despite the hurricane impacts and a strike at Boeing which heavily dented job gains, the unemployment rate sits at 4.1%, and layoffs remain low. |

|

|

Among the weakest spots is manufacturing, as industrial production continues to decline year-over-year. The hurricanes and the Boeing strike heavily impacted the latest industrial production figures. Industrial production has moved sideways since Q2 2022 but should sustainably head northward next year. Lower interest rates will boost business investment, while secular drivers such as artificial intelligence, the CHIPS and IRA legislation, fading drag from past tightening in commercial and industrial lending, and growing electricity demand will remain in place. While the outlook for the economy remains optimistic, elevated interest rates remain a downside risk. Stickier-than-anticipated inflation reports coupled with recent employment reports, which underscore a still-strong labor market, have again shifted the balance of risks for monetary policy. Federal Reserve Chair Jerome Powell stated that the “[t]he economy is not sending any signals that we need to be in a hurry to lower rates.” While our outlook is for another 25bp cut in December followed by three more in 2025, the risk is that the Fed cuts fewer times. Looking into 2025, the U.S. economy is set to outperform other advanced economies, supported by labor growth (regardless of the new administration’s policies), strong investment, and an expansionary fiscal policy. While higher tariffs will be a theme for 2025, there remains some uncertainty about how far the pendulum will swing, and the economic implications are not expected to be felt until late in the year or even in 2026. The impact of lower immigration on the labor market will play out over the years (Figure 4). In part, this is because new immigrants become progressively more attached to the labor market over time, and immigrant cohorts from the previous two years will continue to contribute to labor force gains a year after immigration constraints are implemented. In addition, we expect business equipment spending to rise by more than 5% next year despite policy uncertainty. The fundamentals favor solid growth, but there are five other reasons to be optimistic: past increases in manufacturing structures investment, fiscal policy, ongoing AI-related investment, easing lending standards, and strong economic incentives. Heightened policy uncertainty has historically weighed on business equipment spending, but we expect this drag to be modest, as recession concerns fade and help offset some of the drag from the lack of clarity on policy, especially related to trade. |

|

|

As with many areas, it is difficult to anticipate the specific actions that the Trump Administration and Congress will take over the next several years, and the impact those actions and associated messaging will have on travel. However, we expect growth in Chinese visits to decrease due to increasingly negative rhetoric between the two countries and an acceleration of tit-for-tat trade restrictions. This is in addition to reduced growth from the Middle East due to negative rhetoric and possible visa restrictions. Moreover, growth in international travel from Canada and Mexico is expected to decrease, assuming ill-will toward the U.S. mounts in the wake of new tariffs plus a negative impact on visitation from Mexico following immigration enforcement on the borders.

About CEIR About Oxford Economics Oxford Economics is one of the world’s foremost independent global advisory firms, providing reports, forecasts and analytical tools for 200 countries, 100 industrial sectors and over 3,000 cities. With our Tourism Economics subsidiary, we deploy best-in-class global models and analytical tools to forecast external market trends and assess their business impacts. Headquartered in Oxford, England, with regional centers in London, New York, and Singapore, Oxford Economics has offices across the globe, employing over 600 full-time staff and one of the largest teams of macroeconomists and thought leadership specialists. Learn more at www.tourismeconomics.com / www.oxfordeconomics.com. |