With the kickoff of 2014, many organizations involved in the exhibition industry reflected on the previous year.

Nancy Drapeau, PRC, director of research at CEIR, gave her thoughts of 2013:

Full organization name: Center for Exhibition Industry Research

Date of establishment: 1978

Role in the tradeshow, exhibition and convention industry: To advance the growth, awareness and value of exhibitions and other face-to-face marketing events by producing and delivering research-based knowledge tools that enable stakeholder organizations to enhance their ability to meet current and emerging customer needs, improve their business performance and strengthen their competitive position.

Q: What significant thing happened to the tradeshow industry in 2013?

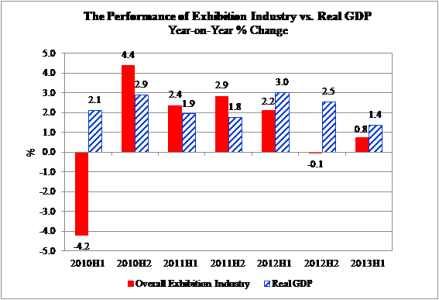

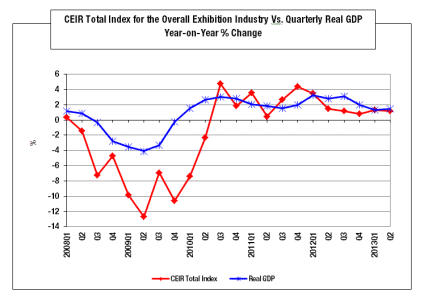

The biggest influence on the exhibition industry is the state of the U.S. economy. Historically, the performance of the industry rises and falls in parallel with the health of the U.S. economy, with U.S. GDP as the economic performance indicator used to compare exhibition industry performance. The CEIR Index, an overall index of the exhibition’s performance has sustained 12 consecutive quarters of growth, consistent with the slow, sluggish growth in U.S. GDP.

Q: What is the most noteworthy accomplishment for your association throughout the year?

CEIR provides insights that keep the various constituencies in the exhibition industry aware of the latest trends in the marketplace, to enable them to plan accordingly, to take advantage of market opportunities and minimize risks and threats in the marketplace.

Our most noteworthy accomplishment throughout the year is the provision of high-quality reports and a live forum, CEIR Predict that meets these needs.

PREDICT took place on Sept. 13 at the Waldorf Astoria in New York City. C-level executives in the exhibition industry came to hear from a range of thought leaders in economics, social media and market leading exhibitions. Keynote and panel speakers discussed current trends and shared ideas on how to plan and succeed in the near-term future. A particularly provocative and well-received addition to the program was City Talk, a first of its kind offering. It included a panel of mayors from first-tier convention center cities, discussing the role of exhibitions, their importance to their cities’ economic development efforts as well as the challenges they struggle with to keep their cities competitive as an attractive destination.

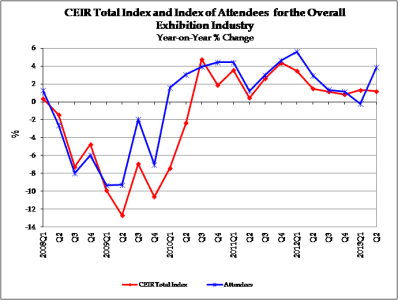

CEIR continues to monitor the performance of the industry through the CEIR Index, reporting how it is faring on a quarterly basis – overall performance, as well as by the key performance metrics of number of attendees and exhibitors, net square footage of paid space and revenues.

Beyond these essential market-level reports, CEIR regularly conducts studies on a range of exhibitor and exhibition organizer practices, as well as monitoring attendee needs and preferences from the exhibition channel. CEIR also publishes Guru reports, which deliver practical, hands-on advice from industry leading experts.

Reports released to-date in 2013 include:

- Reports from the What Attendees Want from Trade Exhibitions Study Series:

- What Attendees Want from Trade Exhibitions

- Attracting Attendees

- Role of Exhibitions in Supporting Organizational Learning

- Generational Differences in Face-to-Face Interaction Preferences and Activities

- Exhibitor Product Information Sharing Practices

- Exhibitor Ancillary Onsite Marketing Practices

- Digital Playbook

- Guru articles:

- Beyond ROI and ROO: Using Measurement to Enhance Decisions and Improve Exhibit Results

- An Exhibit Manager’s Guide to Exhibit Staff Orientation

Q: Did the economy in 2012 improve significantly enough to directly impact the tradeshow industry?

The U.S. economy in 2012 has had a marginal, positive impact on the exhibition industry. The plotting of the CEIR Index compared to U.S. GDP in the first chart illustrates the relationship between the two measures on a quarterly basis since 2008. U.S. GDP growth in 2012 was 2.2 percent while the exhibition industry growth was 1.5 percent. As a matter of course, performance of the exhibition industry tends to trail the economy’s performance.

The U.S. economy in 2012 has had a marginal, positive impact on the exhibition industry. The plotting of the CEIR Index compared to U.S. GDP in the first chart illustrates the relationship between the two measures on a quarterly basis since 2008. U.S. GDP growth in 2012 was 2.2 percent while the exhibition industry growth was 1.5 percent. As a matter of course, performance of the exhibition industry tends to trail the economy’s performance.

The second chart compares exhibition industry performance to U.S. GDP on a semi-annual basis from 2010 through the first half of 2013. It shows the exhibition industry was responding positively to the growth in the economy that was taking hold, though as U.S. GDP growth rates began to slow, so did the exhibition industry growth rates.

Q: Overall, how much more active was the tradeshow industry in 2012 vs. 2013?

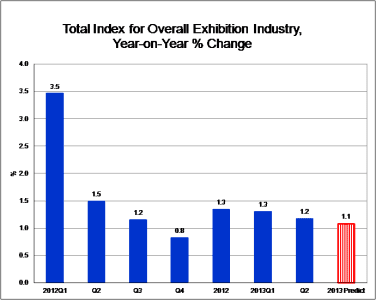

In this chart, the first quarter of 2012 was the most dynamic, enjoying a 3.5 percent rate of growth compared to the prior year. From that point on, growth has become more tepid and is similarly low in the remaining quarters of 2012 and those in 2013.

Q: What developments in 2013 have made you optimistic about 2014?

The fact that the U.S. economy remains in positive growth territory, though admittedly is sluggish, is a source of cautious optimism.

Specific to the exhibition industry, attendance, a leading indicator for the industry, enjoyed an increase of 3.9 percent in the second quarter. Attendance at exhibitions has been positively correlated with overall non-farm payroll employment. As employment increases, attendance should pace in the exhibition industry.

Despite sources for concern, factors that help position the U.S. economy for growth include reduced reliance on foreign sources for energy with increased production of U.S. oil and natural gas; pro-growth policies fueling export-lead manufacturing growth; greater corporate investment, a loosening of cash reserves into new capital investments in the U.S.; and improved household finances combined with low-interest rates and substantial pent-up demand for housing.

In this environment, the U.S. is an attractive market to invest and do business. The exhibition industry is a gateway for companies looking to market and sell their products in North America; therefore, these dynamics present opportunity for the exhibition industry in the U.S.

Q: What is the biggest challenge the industry will face in 2014?

The biggest challenge facing the industry is anything that can negatively impact the economy. To-date, the U.S. has not been able to sustain GDP growth at a clip of 3 percent to 4 percent per annum. Until it does, recovery will be slow as well as growth in the exhibition industry.

Unfortunately, the biggest challenge to the economy is policy or the lack thereof in Washington, D.C., that eclipses the fragile economic recovery that is in play.

Continued sequestration (across-the-board) cuts in discretionary spending along with recent tax increases are anticipated to result in a doubling down of austerity and a projected drag down on GDP by 1.7 percent in 2013. If sequestration continues, it will continue to negatively impact growth in the economy and, therefore, the exhibition industry.

Sequestration has already had a negative impact on the exhibition industry, with a decline in attendance among exhibitions that rely on government employees.

With fewer dollars available to local governments, for convention centers heavily reliant on subsidies to run their programs, it will impact efforts to maintain and enhance existing facilities.

The recent government shutdown and flirting with not raising the debt ceiling, thus putting the federal government in default for the first time in its history has created substantial uncertainty. These D.C. created crises suppress the economic rebound, and with more important decisions looming, failure to make decisions or to make decisions that force further austerity measures may cause more harm.

With these uncertainties still present, businesses may decide to hold onto cash reserves or delay investments, which could prompt weaker growth and activity in the exhibition industry. If issues are resolved, anticipate stronger growth.

Another risk to monitor is financial turmoil in the euro-zone. If this region continues to struggle with recessionary pressures, it will depress demand for U.S. exports and thus reduce U.S. GDP growth and, ultimately, performance of the exhibition industry.

See related article: “Year in review part two: E2MA.”