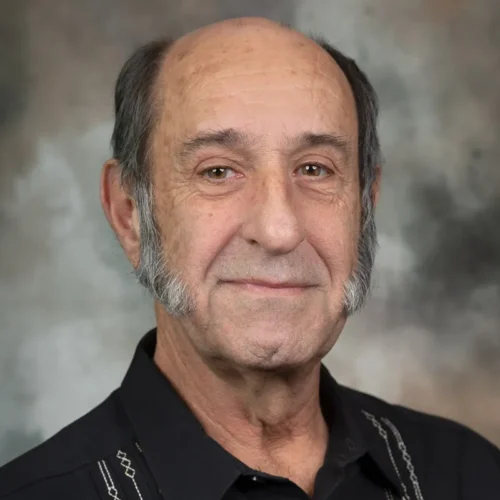

(Cathy Breden, pictured above, CEIR chief executive officer, speaks about the exhibition industry’s economy at the CEIR Predict Conference in 2018.)

The Center for Exhibition Industry Research in Dallas released the 2019 CEIR Index Report on April 24, analyzing the 2018 exhibition industry and providing an economic and exhibition industry outlook for the next three years.

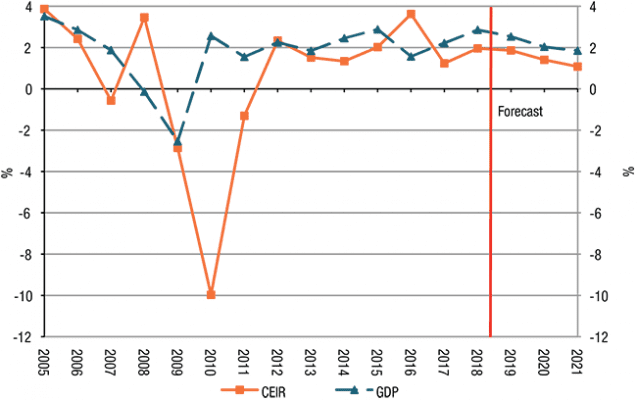

The U.S. economy accelerated in 2018, rising from 2.2 percent growth in 2017 to 2.9 percent in 2018, representing nine consecutive years of growth. Nonresidential investment led the economy, with personal consumption and federal defense expenditures providing support. The widening trade gap partially offset GDP growth. GDP expansion in the next few years will be driven by moderate growth in personal consumption expenditures and private investment spending; higher spending levels of both are helped by recent tax cuts.

According to CEIR’s current projection, real GDP growth will ebb to around 2.5 percent in 2019 before decelerating further to 2 percent in 2020 and 1.8 percent in 2021.

In 2018, the exhibition industry’s performance finally surpassed its last peak and is now anticipated to break new ground performance-wise through 2021. The Total Index, a measure of overall exhibition industry performance, increased by a moderate 1.9 percent, just slightly lower than the 2 percent gain in 2017. All four metrics rose in 2018, with real revenues leading at 3.6 percent above 2017 levels. Both attendees and net square feet (NSF) rose 1.7 percent, whereas exhibitors gained 0.5 percent.

Exhibition developments in 2018 varied widely by industry. The leading sector was government (GV), surging 7.8 percent. Food (FD) and Discretionary Consumer Goods and Services (CS) also had strong showings, rising by 5.4 percent and 3.6 percent, respectively. On the other end of the spectrum, the sector most challenged was Financial, Legal and Real Estate (FN), for which the index declined by 2.6 percent. Consumer Goods and Retail Trade (CG) was the second most challenged sector, dropping 1.8 percent.

“Moderate economic, job and personal disposable income growth should continue to drive exhibitions,” says CEIR Economist Allen Shaw, chief economist for Global Economic Consulting Associates. “However, the downward secular trend in FN, CG and Education (ED) will exert a drag on the overall performance of the exhibition industry. CEIR expects the Total Index growth to slow to 1.4 percent, 0.5 percentage points lower than the 2018 rate and 1.0 percentage point behind real GDP growth. Exhibition performance will further slow modestly to 1.1 percent in 2020 and 0.8 percent in 2021 as the economy settles into a slower but more sustainable growth path.”

“Moderate economic, job and personal disposable income growth should continue to drive exhibitions,” says CEIR Economist Allen Shaw, chief economist for Global Economic Consulting Associates. “However, the downward secular trend in FN, CG and Education (ED) will exert a drag on the overall performance of the exhibition industry. CEIR expects the Total Index growth to slow to 1.4 percent, 0.5 percentage points lower than the 2018 rate and 1.0 percentage point behind real GDP growth. Exhibition performance will further slow modestly to 1.1 percent in 2020 and 0.8 percent in 2021 as the economy settles into a slower but more sustainable growth path.”

CEIR Index provides data on exhibition industry performance across 14 key industry sectors: Business Services (BZ); Consumer Goods and Services (CG); Discretionary Consumer Goods and Services (CS); Education (ED); Food (FD); Financial, Legal and Real Estate (FN); Government (GV); Building, Construction, Home and Repair (HM); Industrial/Heavy Machinery and Finished Business Inputs (ID); Communications and Information Technology (IT); Medical and Health Care (MD); Raw Materials and Science (RM); Sporting Goods, Travel and Entertainment (ST); and Transportation (TX).

After its initial release, a forecast update of the CEIR Index will be presented at the CEIR Predict conference on Sept. 16-17 at the MGM National Harbor. The conference will provide exhibition professionals with macroeconomic insights, as well as insights into why things are happening as opposed what is happening.

“This will be our ninth annual Predict conference and we are eager to share new information and perspectives that industry executives have come to rely on from CEIR,” says CEIR Chief Executive Officer Cathy Breden. “The data from the latest CEIR Index, combined with the knowledge of guest economist Dr. Lindsey Piezga, along with other forward-looking sessions will provide attendees with an excellent predictive edge to use in their future strategic planning and business development efforts.”

The Center for Exhibition Industry Research serves to advance the growth, awareness and value of exhibitions and other face-to-face marketing events by producing and delivering knowledge-based research tools that enable stakeholder organizations to enhance their ability to meet current and emerging customer needs, improve their business performance and strengthen their competitive position. For more info, visit www.ceir.org.